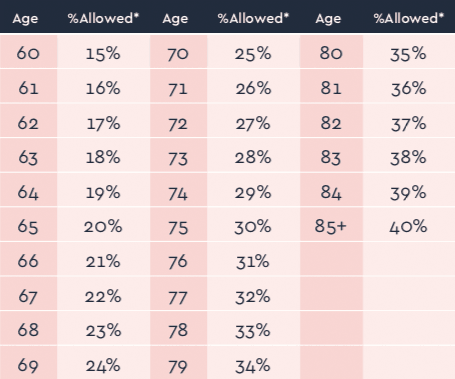

Maximum Loan Amount

This depends on the value of your property and your age at the start of the loan (see table).

For example if you are 60 you may borrow 15% of the value of the property but if you are 85 or older you may borrow 40%.

*This is the percentage of the property’s value that can be borrowed, also known as the Loan to Value ratio or LTV. If there are two nominated residents the age of the younger nominated resident is used to determine the percentage allowed.

Overall Maximum

Irrespective of age or property value, the overall maximum amount that can be borrowed is €500,000.

At its absolute discretion (for example where it is difficult to accurately value a property) Seniors Money may make a loan offer at a lower amount than indicated by the LTV table.

Use our Lifetime Loan Calculator to see how much you could borrow based on your own age and house value.

Lump sum options

The maximum possible loan amount depends on your age and the value of your property (see here). You can choose how much of this maximum to borrow as a lump sum.

Full amount as a lump sum

This should only be done if the maximum amount is required to meet your financial needs and objectives – see here ».

Specific smaller amount as a lump sum

Choose this to ensure you are only borrowing the amount required to meet your identified financial needs and objectives.

You should however also be aware that, if you borrow less than the maximum possible amount, there is no guarantee that you will be able to borrow further amounts at a future date. A new loan application would be required.