Pension research shows growing role in equity release in retirement planning

New pensions research from the Competition and Consumer Protection Commission (CCPC) brings into sharp focus the challenges Irish people face when it comes to funding retirement.

Almost a quarter of those questioned (23%) aged 55-64 – those expecting to retire in the next decade – reported that they don’t currently have a pension in place.

The State Contributory pension (currently €253 per week) plays a significant role in the financial planning of most people as a means of funding retirement. Of the 735 adults of all ages who took part in the research, two-thirds (66%) stated that they would be using it.

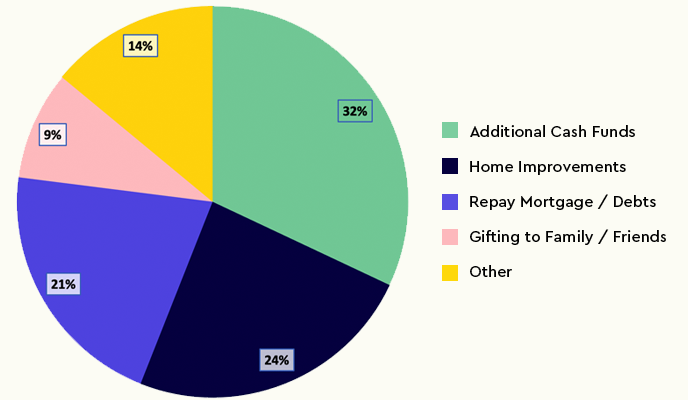

However, many respondents intend to supplement their pension plans with a variety of other forms of retirement funding, including selling a property (24%), rental income (23%), equity release (15%), and selling a business (14%).