Green Lifetime Loan

The Green Lifetime Loan could help you live a greener life

We’ve always been here to help you live a greater life in later life. Now we’re here to help you live a greener life in later life and we are trying to make it simple and easy for you to be green. The new Green Lifetime Loan mirrors all the features of the standard Lifetime Loan with the added benefits of a reduced interest rate of 6.50% and a reduced set-up fee of €1,350.

3 options for qualification for a Green Lifetime Loan

Helping to make it easier to be green

- If you have an existing Building Energy Rating (BER) of B3 or higher and can provide a BER certificate with your Lifetime Loan application;

- If you intend using your Lifetime Loan to fund energy efficient home improvements to achieve a BER rating of B3 or better within 12 months of drawing down your loan; and/or

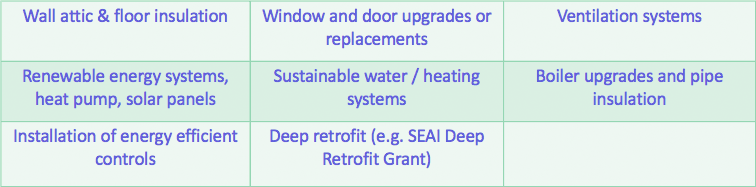

- If you intend using more than 50% of your Lifetime Loan for qualifying home improvements within 12 months of drawing down your loan

| You may be required to provide a copy of your home’s BER Certificate and/or invoices evidencing home improvements completed within 12 months of drawing down the loan. |