How much can you borrow?

The maximum amount you can borrow is determined by your age and the value of your property, for more detail click the link here to see the lifetime loan full breakdown. Or you can use the calculator below to calculate your maximum amount.

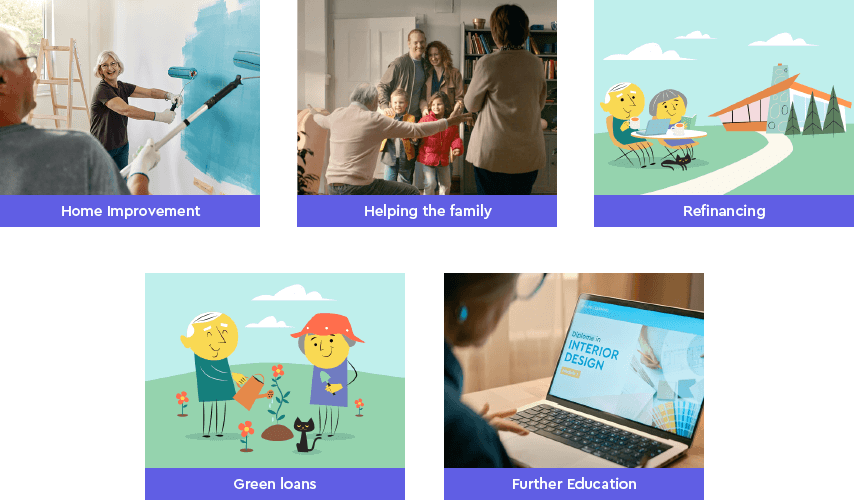

Reasons for taking out a lifetime loan

You can use the money you receive for whatever you wish, there are lots of different reasons, but we find these are some of the most common:

- To do home improvements

- To pursue further education

- To refinance existing loans

- To help those close to you